A Comprehensive Comparison of Medicare Advantage vs. Medicare Supplement Plan G

Understanding Your Healthcare Choices: Finding the Right Plan for Your Retirement

As the complexities of healthcare continue to evolve, choosing the right Medicare plan can feel overwhelming. For those eligible, deciding between Medicare Advantage and Medicare Supplement Plan G hinges on understanding how each plan aligns with your lifestyle, health needs, and financial planning. Here's a detailed look to help you navigate this crucial decision.

Understanding the Basics:

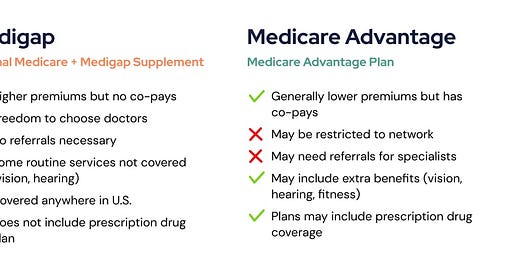

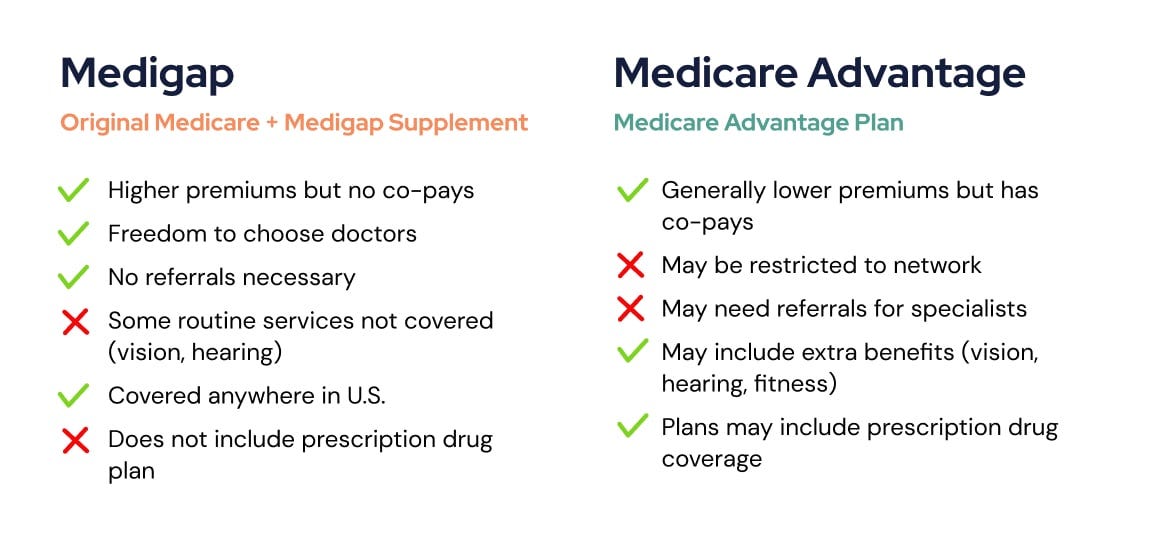

Choosing between Medicare Advantage and a Medicare Supplement Plan like Plan G involves understanding the comprehensive needs of your healthcare scenario, alongside recognizing the inherent limitations of Original Medicare (Parts A and B). Original Medicare, while foundational, leaves beneficiaries vulnerable to significant out-of-pocket costs through deductibles, coinsurance, and copayments, particularly for those with chronic conditions or needing frequent medical attention. Medicare Supplement Plan G steps in to cover most of these gaps, providing a nearly all-inclusive safety net minus the Part B deductible, which offers the flexibility of choosing any doctor or specialist nationwide. This plan is particularly beneficial for individuals who value predictability in healthcare costs and travel often or reside in multiple states. On the other hand, Medicare Advantage, or Part C, offers an alternative by bundling services that might include Parts A, B, and often D, alongside possible extras like dental or vision care, appealing to those looking for lower premiums or additional benefits at potentially lower costs. However, this comes with network restrictions and could lead to higher out-of-pocket expenses if care outside the network is required. The decision hinges on whether one prioritizes comprehensive coverage with flexibility (Plan G) or lower premiums with additional benefits but within network limitations (Medicare Advantage). This choice is further complicated by the dynamic health needs over time, suggesting that while one option might suit current conditions, the other might become advantageous with changes in health or lifestyle. Ultimately, understanding these options, alongside recognizing the gaps left by Parts A and B, is crucial for making an informed decision tailored to one's health profile, lifestyle, and financial planning.

Medicare Advantage (Part C) is an "all-in-one" alternative to Original Medicare. It's offered by private companies approved by Medicare and typically includes Parts A (hospital insurance) and B (medical insurance), and often Part D (prescription drug coverage). Some plans also offer extra benefits not covered by Original Medicare, like dental or vision care.

Medicare Supplement Plan G, on the other hand, works alongside Original Medicare. It's designed to cover some or all of the out-of-pocket costs that Original Medicare doesn't cover, such as copayments, coinsurance, and deductibles, except for the Part B deductible which you must pay before Plan G starts covering costs.

1. Healthcare Flexibility

- Medicare Supplement Plan G: Offers the ultimate in flexibility. You can visit any doctor or hospital nationwide that accepts Medicare. No referrals are needed for specialists, providing unrestricted access to healthcare wherever you are.

- Medicare Advantage: Typically restricts you to a network of healthcare providers. Going out-of-network might require prior authorization or lead to higher costs, which might not be ideal for those who prefer or need flexibility in their healthcare choices.

2. Travel and Residency

- Plan G: Ideal for frequent travelers or those with homes in multiple states. The coverage follows you regardless of where you travel within the U.S., providing peace of mind for medical emergencies or routine care away from home.

- Medicare Advantage: Coverage can be tied to specific geographic areas. If you travel extensively or spend significant time outside your plan's service area, you might find yourself with limited coverage or higher costs.

3. Cost Predictability

- Plan G: While premiums might be higher, the costs are more predictable. After paying the Part B deductible, Plan G covers most out-of-pocket costs, reducing the likelihood of surprise medical bills.

- Medicare Advantage: Often has lower premiums, appealing to budget-conscious individuals. However, this can come with higher copays, coinsurance, and annual limits on out-of-pocket spending, which might lead to unpredictable healthcare costs, especially for those with chronic conditions requiring frequent care.

4. Extra Benefits

- Medicare Advantage: Many plans offer additional benefits like dental, vision, or wellness programs, which can be attractive if these services are important to you but not covered by Original Medicare.

- Plan G: Focuses solely on covering Medicare's gaps. If you desire additional benefits, you would need to purchase separate policies or coverage, which might increase your total healthcare spending.

5. Health Status

- Plan G: Suits individuals who anticipate needing comprehensive medical care or those with ongoing health issues. The unrestricted access to healthcare providers ensures you're not limited by network restrictions when seeking specialist care.

- Medicare Advantage: Could be more cost-effective for those who are generally healthy, requiring less medical intervention. However, if your health status changes, switching might not be as straightforward, especially during times other than the annual enrollment period.

Conclusion

Choosing between Medicare Advantage and Medicare Supplement Plan G involves weighing flexibility, cost, travel needs, and additional benefits against your current and future health needs. If predictability, flexibility, and comprehensive coverage without network restrictions are your priorities, Medicare Supplement Plan G stands out. Conversely, if you're looking for potentially lower costs, additional benefits, and are willing to navigate network limitations, Medicare Advantage might be more suitable.

Remember, your choice today might not be set in stone. Life circumstances change, and Medicare allows for some flexibility in switching plans annually. However, understanding your options thoroughly now can significantly impact your healthcare experience and financial planning for years to come.

Have Questions visit our website & speak with a licensed Medicare professional today!

https://beacons.ai/richardbattell

Very nice summary.